property tax las vegas nv

Overall there are three stages to real property taxation. Las Vegas - Property Tax Services.

Newspaper 2007 Nevada Tax Change Cut Cost Of Property Deals Serving Carson City For Over 150 Years

You can expect to see property taxes calculated at about 5 to 75 of the homes purchase price.

. Every municipality then receives the assessed amount it levied. Real Property Tax Auction Information. A Las Vegas Property Records Search locates real estate documents related to property in Las Vegas Nevada.

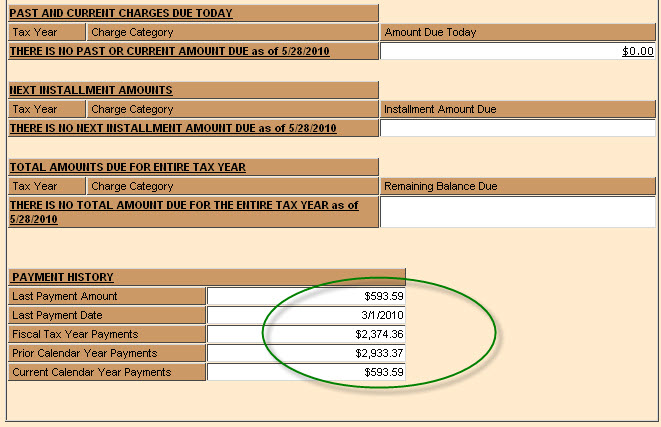

Payment Options for Real Property Taxes only Mail. The Treasurers office mails out real property tax bills ONLY ONE TIME each fiscal year. The exact property tax levied depends on the county in Nevada the property is located in.

Some of these include veterans disabled veterans surviving spouses blind. Search Homes Our Team Our Agents Las Vegas Communities Housing. Las Vegas Property Taxes - how to calculate property taxes in Nevada and how to learn more.

Apply for a Business License. Las Vegas NV 89106. Property Tax Rates for Nevada Local Governments Redbook NRS 3610445 also requires the Department to post the rates of taxes imposed by various taxing entities and the revenues.

Las Vegas NV 89106. Property owners have two years from the date of the certificate to redeem the. Las Vegas NV 89155-1220.

We encourage taxpayers to pay their real property taxes using our online service or automated phone system. Doing Business with Clark County. Warm Springs Rd Suite 200 Las Vegas.

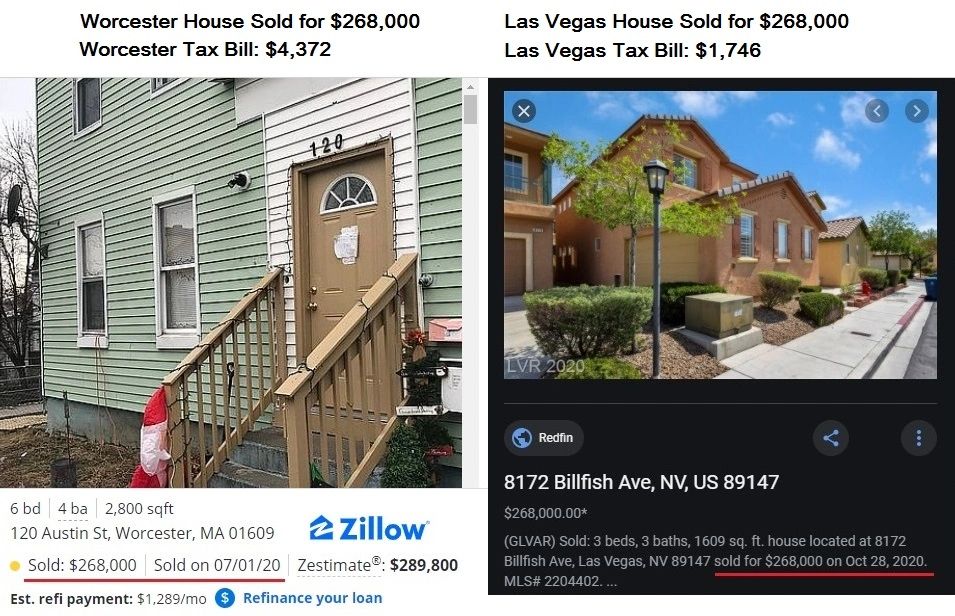

In Nevada the market value of. Property Tax In Clark County- is about 1 of the property. Office of the County Treasurer.

Las Vegas Real Estate Calculating Las Vegas Property Taxes. 866 962-3707 LAS VEGAS OFFICE 700 E. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties.

Las Vegas Tax Records include documents related to property taxes business taxes sales tax employment taxes and a range of other taxes in Las Vegas Nevada. By E-check or credit card Visa MasterCard. As highly respected unbiased third-party specialists in property tax consulting management valuations and appeals our clients depend on us to.

Calculating Las Vegas Property Taxes. Las Vegas NV currently has 3994 tax liens available as of November 21. You may pay in person at 500 S Grand.

15 to determine whether they want to contest the taxable value of. Property tax las vegas nv. The Nevada Legislature provides for property tax exemptions to individuals meeting certain requirements.

If you do not receive your tax bill by August 1st each year please use the automated telephone. The states average effective property tax rate is just 053. Facebook Twitter Instagram Youtube NextDoor.

To calculate the tax on a new home that does not qualify for the tax. STATE OF NEVADA DEPARTMENT OF TAXATION Web Site. Washoe County collects the highest property tax in Nevada levying an average of 188900.

The best available Internet option for 3863 Via. Homeowners in Nevada are protected from steep increases in. Las Vegas Nevada 89155-1220.

Compared to the 107 national average that rate is quite low. What is the Property Tax Rate for Las Vegas Nevada. Establishing tax levies evaluating property worth and then collecting.

Las Vegas NV 89155-1220. The rate in Las Vegas for fiscal year 2017 to 2018 is about 33 according to the Clark County Treasurers office. Public Property Records provide information on land homes and.

500 S Grand Central Pkwy 1st Floor.

Living In Las Vegas Nv Pros And Cons Of Moving To Las Vegas 2022 Retirebetternow Com

How To Reduce Your Property Taxes In Las Vegas Henderson Clark County Nv Youtube

5958 Boulder Hwy Las Vegas Nv 89122 Land For Sale Boulder Highway 2 76 Acre Development Site

New Construction Homes In Nevada Toll Brothers

Worcester Property Tax Burden 52 3 Higher Than National Average

2022 Property Tax Rates In Las Vegas Virtuance Blog

Blackstone S 5 65b Sale Of Cosmopolitan Las Vegas Sees No Real Estate Transfer Taxes Due To Nevada S 2007 Law Change Yogonet International

Proposed Floor For Property Tax Caps Draws Opposition Nevada Current

2252 Bassler St North Las Vegas Nv 89030 Redfin

6429 Jacobville Court Las Vegas Nv 89122 Compass

Las Vegas Housing Market Prices Trends Forecast 2022 2023

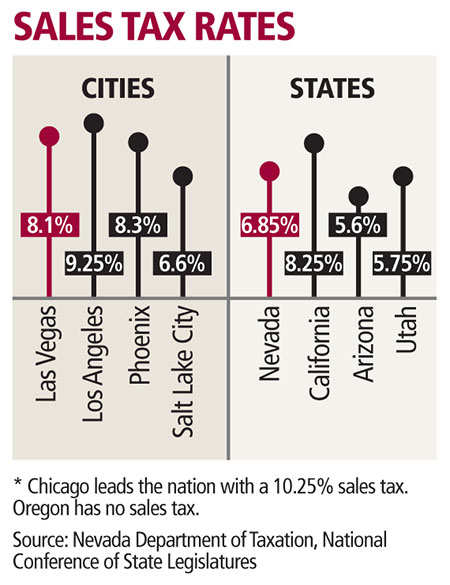

Nevada Tax Rates And Benefits Living In Nevada Saves Money

Nevada Property Tax Property Tax Resources

Property Taxes In Las Vegas Nv The Cramer Group At Urban Nest Realty

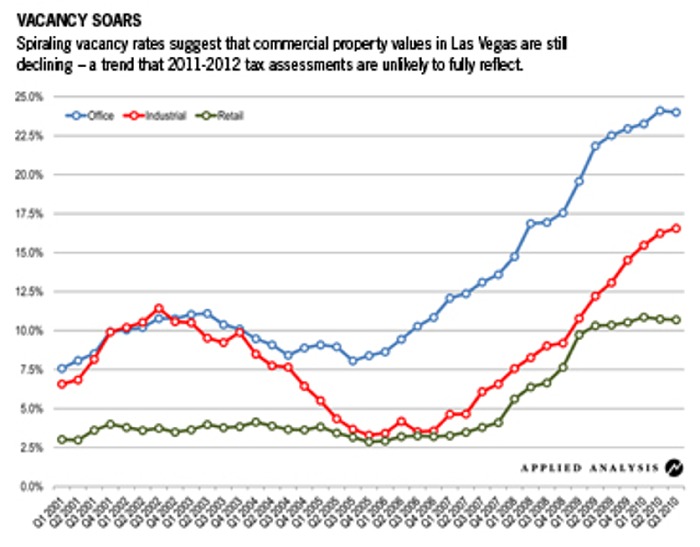

Taxes About To Increase Las Vegas Review Journal

Top 4 Reasons Why You Should Buy Anthem Las Vegas Homes For Sale Las Vegas Homes Las Vegas Las Vegas Free

Las Vegas Vs Clark County There Are Differences Between Living In City Limits And Unincorporated County Land Las Vegas Sun Newspaper

Calculating Las Vegas Property Taxes Las Vegas Real Estate Las Vegas Homes For Sale Las Vegas Real Estate